Roller-coaster year for IAS includes largest ever acquisition

Integrated Assembly Solutions (IAS) Spot On

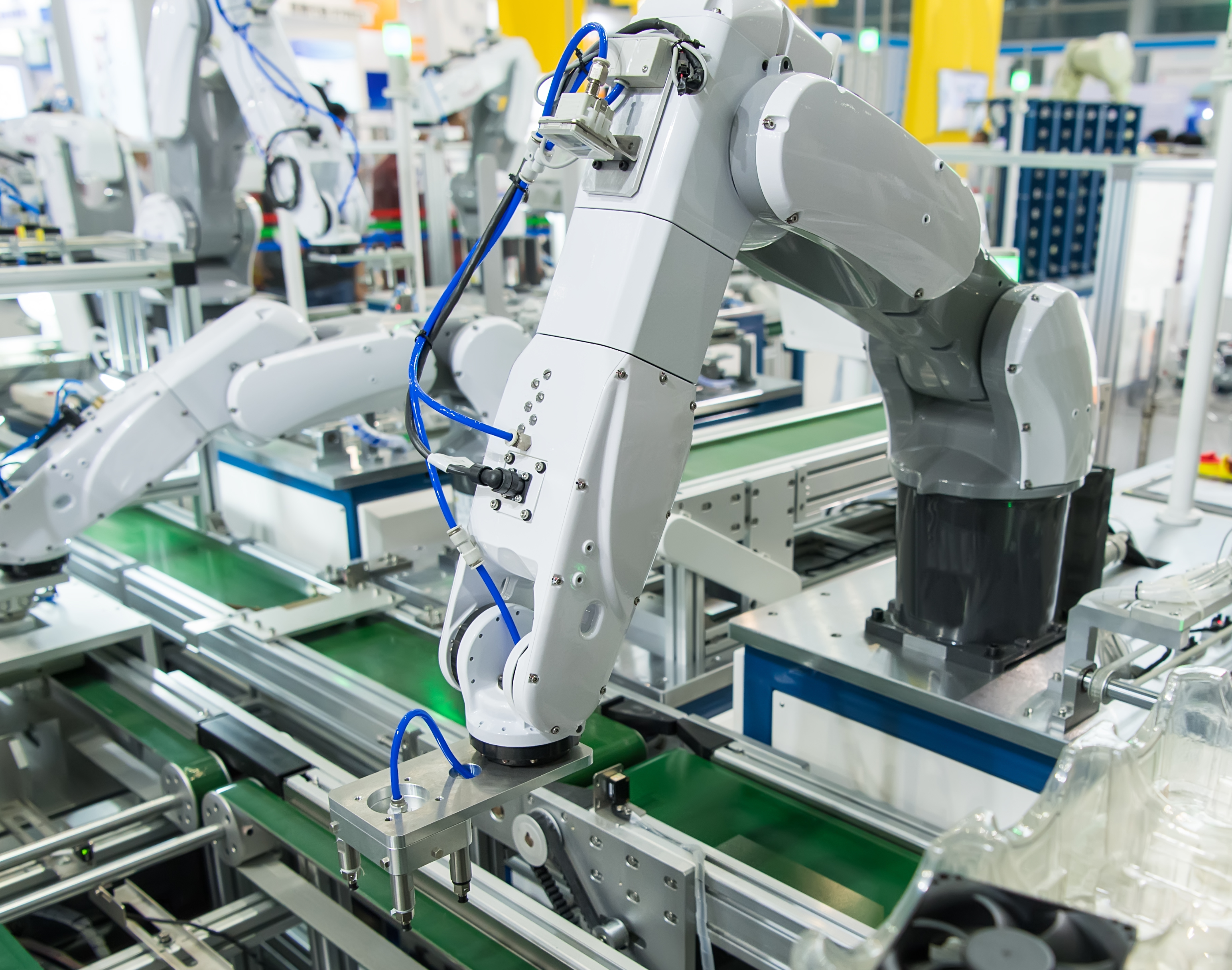

While the world’s economic situation becomes increasingly testing, the integrated assembly solutions (IAS) segment is going through a process of change and at the same time offering investors attractive opportunities.

Following up the report from March this year, Oaklins’ IAS specialist Martin Steidle looks at current market trends, key recent events and M&A activity in the segment, and provide a valuation update.

Spotlight

This year saw the IAS segment’s biggest ever transaction, as Hitachi acquired the US company JR Automation. The move ties in with the Japanese conglomerate’s positioning as a system partner for the transition from machine manufacturing to robotic automation, and its identification of the North American market as a target. We take a detailed look at the acquisition, which marks a high point in IAS for 2019.

Talk to our industry specialists

Director

View profile

Managing Director

View profile

Managing Partner

View profile

Director

View profile